Pressemitteilung -

Garmin Reports Second Quarter Revenue and Earnings Growth; Raises Guidance for 2018

Schaffhausen, August 2, 2018 – Garmin Ltd. announced results for the second quarter ended June 30:

Highlights for the second quarter 2018 inlcude:

- Total revenue of $894 million, growing 8% over the prior year, with fitness, marine, aviation and outdoor collectively growing 17% over the prior year quarter and contributing 80% of total revenue

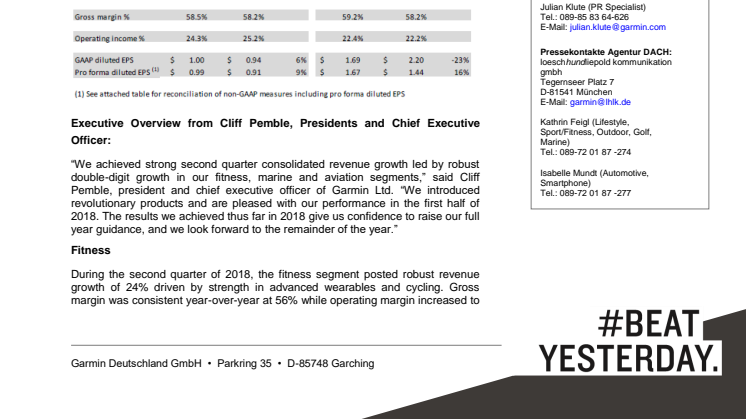

- Gross margin of 58.5% compared to 58.2% in the prior year quarter

- Operating margin of 24.3% compared to 25.2% in the prior year quarter

- Operating income was $218 million, growing 4% over the prior year quarter

- GAAP EPS was $1.00 and pro forma EPS(1) was $0.99

- Launched the vívoactive® 3 music expanding our music offerings into the advanced wellness category

- Introduced the new revolutionary Panoptix LiveScopeTM delivering the first and only live scanning sonar for recreational fishing

- Launched the fēnix® 5 Plus series of watches with built-in color maps, Garmin PayTM mobile payments, music storage and added Pulse Ox sensor technology for blood oxygen saturation awareness to the fēnix 5X Plus

Executive Overview from Cliff Pemble, Presidents and Chief Executive Officer:

“We achieved strong second quarter consolidated revenue growth led by robust double-digit growth in our fitness, marine and aviation segments,” said Cliff Pemble, president and chief executive officer of Garmin Ltd. “We introduced revolutionary products and are pleased with our performance in the first half of 2018. The results we achieved thus far in 2018 give us confidence to raise our full year guidance, and we look forward to the remainder of the year.”

Fitness

During the second quarter of 2018, the fitness segment posted robust revenue growth of 24% driven by strength in advanced wearables and cycling. Gross margin was consistent year-over-year at 56% while operating margin increased to 23%, resulting in operating income growth of 40%. During the second quarter, we launched the vívoactive 3 music expanding our music offerings into the advanced wellness category. We also launched new Edge® and VariaTM cycling products providing growth to our cycling category with innovative new products and a continued focus on cyclists’ safety. We continue to see opportunities for advanced wearables within the fitness segment.

Marine

The marine segment posted robust revenue growth of 24% driven by organic growth across multiple product categories and our Navionics® acquisition. Gross margin increased year-over-year to 59%. Operating margin declined to 21%, however operating income grew by 14%. During the second quarter of 2018, we introduced the award winning Panoptix LiveScope, a live scanning sonar that allows anglers a real-time clear image in front of, below, and around their boat. Additionally, we were selected as the exclusive marine electronics supplier to Sportsman Boats beginning in model year 2019. We remain focused on innovations and achieving market share gains within the inland fishing category.

Aviation

The aviation segment posted robust revenue growth of 23%. Gross and operating margins were strong at 74% and 34%, respectively, resulting in operating income growth of 34%. Growth was primarily driven by our ADSB offerings and recent new product introductions such as the G5 indicator system, TXi displays, and the GFCTM 500/600 autopilots. We introduced the G3000HTM integrated flight deck for the Part 27 turbine helicopter market. In addition, we were recently selected by Tactical Air Support to provide a tandem integrated flight deck to their fleet of F-5 supersonic aircraft. We continue to invest in upcoming certifications with our OEM partners and ongoing aftermarket opportunities.

Auto

The auto segment recorded a decline in revenue of 19% in the second quarter of 2018, primarily due to the ongoing PND market contraction. Gross and operating margins were 42% and 7%, respectively. Looking forward, we are focused on disciplined execution to bring desired innovation to the market and to optimize profitability in this segment. Additional Financial Information: Total operating expenses in the quarter were $306 million, an 11% increase from the prior year. Research and development increased 11% driven by the incremental costs associated with acquisitions, investments in the outdoor and fitness segments for the development of advanced wearable products and continued innovation in the aviation segment. Selling, general and administrative expenses increased 14% driven primarily by personnel related expenses and incremental costs associated with acquisitions. Advertising expenses increased 4% year over-year but were relatively flat as a percentage of sales. The effective tax rate in the second quarter of 2018 was 19.4% compared to the effective tax rate of 24.5% and the pro forma effective tax rate of 21.4% in the prior year quarter (see attached table for reconciliation of this non-GAAP measure). The decrease in the current quarter effective tax rate is primarily due to the benefits from U.S. tax reform. In the second quarter of 2018, we generated $224 million of net cash provided by operating activities and $157 million of free cash flow (see attached table for reconciliation of this non-GAAP measure). We continued to return cash to shareholders with our quarterly dividend of approximately $100 million. We ended the quarter with cash and marketable securities of approximately $2.4 billion.

Additional Financial Information

Total operating expenses in the quarter were $306 million, an 11% increase from the prior year. Research and development increased 11% driven by the incremental costs associated with acquisitions, investments in the

outdoor and fitness segments for the development of advanced wearable products and continued innovation in the aviation segment. Selling, general and administrative expenses increased 14% driven primarily by personnel related expenses and incremental costs associated with acquisitions. Advertising expenses increased 4% year over-year but were relatively flat as a percentage of sales.

The effective tax rate in the second quarter of 2018 was 19.4% compared to the effective tax rate of 24.5% and the pro forma effective tax rate of 21.4% in the prior year quarter (see attached table for reconciliation of this non-GAAP measure). The decrease in the current quarter effective tax rate is primarily due to the benefits from U.S. tax reform.

In the second quarter of 2018, we generated $224 million of net cash provided by operating activities and $157 million of free cash flow (see attached table for reconciliation of this non-GAAP measure). We continued to return cash to shareholders with our quarterly dividend of approximately $100 million. We ended the quarter with cash and marketable securities of approximately $2.4 billion.

2018 Guidance

Based on our performance in the first half of 2018, we are updating our full year guidance. We now anticipate revenue of approximately $3.3 billion driven primarily by higher expectations for our fitness and aviation segments partially offset by slightly lower expectations for the marine segment. Our outlook for the outdoor and auto segments are unchanged. We anticipate our full year pro forma EPS will be approximately $3.30 based on gross margin of about 58.5%, operating margin of about 21.5% and a full year pro forma effective tax rate of about 17.5%.

Revenue Standard Adoption

We adopted the new revenue standard in the first quarter of 2018. The prior periods presented have been restated to reflect adoption of this new standard.

This release includes projections and other forward-looking statements regarding Garmin Ltd. and its business that are commonly identified by words such as “would,” “may,” “expects,” “estimates,” “plans,” “intends,” “projects,” and other words or phrases with similar meanings. Any statements regarding the Company’s GAAP and pro forma estimated earnings, EPS, and effective tax rate, and the Company’s expected segment revenue growth rates, consolidated revenue, gross margins, operating margins, currency movements, expenses, pricing, new products to be introduced in 2018, statements relating to possible future dividends and the Company’s plans and objectives are forward-looking statements. The forward-looking events and circumstances discussed in this release may not occur and actual results could differ materially as a result of risk factors and uncertainties affecting Garmin, including, but not limited to, the risk factors that are described in the Annual Report on Form 10-K for the year ended December 30, 2017 filed by Garmin with the Securities and Exchange Commission (Commission file number 0-31983). A copy of Garmin’s 2017 Form 10-K can be downloaded from

https://www.garmin.com/en-US/company/investors/sec/form-10-K/

Non-GAAP Financial Measures

This release and the attachments contain non-GAAP financial measures. A reconciliation to the nearest GAAP measure and a discussion of the Company's use of these measures are included in the attachments.

Garmin, the Garmin logo, the Garmin delta, vívoactive, Edge, Navionics, fēnix and inReach are trademarks of Garmin Ltd. or its subsidiaries and are registered in one or more countries, including the U.S.; Garmin Pay, GFC, G3000H, Panoptix LiveScope and Varia are trademarks of Garmin Ltd. or its subsidiaries. All other brands, product names, company names, trademarks and service marks are the properties of their respective owners. All rights reserved

Non-GAAP Financial Information

To supplement our financial results presented in accordance with GAAP, this release includes the following measures defined by the Securities and Exchange Commission as non-GAAP financial measures: pro forma net income (earnings) per share, forward-looking pro forma earnings per share, pro forma effective tax rate, forward-looking pro forma effective tax rate and free cash flow. These non-GAAP measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may be different from non-GAAP measures used by other companies, limiting the usefulness of the measures for comparison with other companies. Management believes providing investors with an operating view consistent with how it manages the Company provides enhanced transparency into the operating results of the Company, as described in more detail by category below.

The tables below provide reconciliations between the GAAP and non-GAAP measures.

Pro forma effective tax rate

The Company’s income tax expense is periodically impacted by discrete tax items that are not reflective of income tax expense incurred as a result of current period earnings. Therefore, management believes disclosure of the effective tax rate and income tax provision before the effect of certain discrete tax items are important measures to permit investors' consistent comparison between periods. In the first and second quarters of 2018, there were no such discrete tax items identified.

The net release of uncertain tax position reserves, amounting to approximately $3.5 million and $1.0 million in the first quarter 2018 and 2017, respectively, have not been included as pro forma adjustments in the above presentation as such amounts tend to be more recurring in nature, and do not affect comparability between periods.

The net release of uncertain tax position reserves, amounting to approximately $10.3 million and $2.9 million in the 26-weeks ended June 30, 2018 and July 1, 2017, respectively, have not been included as pro forma adjustments in the above presentation of pro forma income tax provision as related items tend to be more recurring in nature or such amounts are individually not significant.

Pro forma net income (earnings) per share

Management believes that net income (earnings) per share before the impact of foreign currency gains or losses and certain discrete income tax items, as discussed above, is an important measure in order to permit a consistent comparison of the Company’s performance between periods.

Free cash flow

Management believes that free cash flow is an important financial measure because it represents the amount of cash provided by operations that is available for investing and defines it as operating cash less capital expenditures for property and equipment. Management believes that excluding purchases of property and equipment provides a better understanding of the underlying trends in the Company’s operating performance and allows more accurate comparisons of the Company’s operating results to historical performance. This metric may also be useful to investors, but should not be considered in isolation as it is not a measure of cash flow available for discretionary expenditures. The most comparable GAAP measure is cash provided by operating activities.

Forward-looking pro forma tax rate

Forward-looking pro forma tax rate and pro forma earnings per share are calculated before the effect of certain discrete tax items. Management believes certain discrete tax items may not be reflective of income tax expense incurred as a result of current period earnings. Therefore, in order to permit consistent comparison between periods, the tax rate and earnings per share before the effect of such discrete tax items are important measures. At this time management is unable to determine whether or not significant discrete tax items will be identified in fiscal 2018.

Forward-looking pro forma earnings per share (EPS)

In addition to the discrete tax items discussed in the forward-looking pro forma effective tax rate section above, our forward looking 2018 pro forma EPS excludes foreign currency exchange gains and losses. The estimated impact of such foreign currency gains and losses cannot be reasonably estimated on a forward-looking basis due to the high variability and low visibility with respect to non-operating foreign currency exchange gains and losses and the related tax effects of such gains and losses. The impact of such foreign currency gains and losses, net of tax effects, was $0.01 for the 26-weeks ended June 30, 2018.

Themen

Kategorien

Über Garmin

Garmin entwickelt seit mehr als 25 Jahren mobile Produkte für Piloten, Segler, Autofahrer, Golfspieler, Läufer, Fahrradfahrer, Bergsteiger, Schwimmer und für viele aktive Menschen. Von Automotive über Fitness und Outdoor bis hin zu Marine und Aviation hat Garmin seit der Gründung 1989 über 190 Millionen Produkte verkauft. Über 11.500 Mitarbeiter arbeiten heute weltweit in 50 Niederlassungen daran, ihre Kunden ganz nach dem Motto #BeatYesterday dabei zu unterstützen gesünder zu leben, sich mehr zu bewegen, wohler zu fühlen, oder Neues zu entdecken. Garmin zeichnet sich durch eine konstante Diversifikation aus, dank derer Fitness & Health Tracker, Smartwatches, Golf- und Laufuhren erfolgreich etabliert werden konnten. Das Unternehmen mit Hauptsitz in Schaffhausen (CH) ist in der DACH-Region mit Standorten in Garching bei München (D), Graz (A) und Neuhausen am Rheinfall (CH) vertreten. In Würzburg (D) wird außerdem ein eigener Forschungs- und Entwicklungsstandort unterhalten. Ein zentrales Erfolgsprinzip ist die vertikale Integration: Die Entwicklung vom Entwurf bis zum verkaufsfertigen Produkt sowie der Vertrieb verbleiben weitestgehend im Unternehmen. So kann Garmin höchste Qualitäts- und Designstandards garantieren und seine Kunden täglich aufs Neue motivieren.